Here’s a shocker: Most (90%) Americans are stressed about money. It’s the #1 most stressful aspect of our lives.

Can you believe it? Yes, of course, you can. Even if you’re one of the 10% that are not stressed about money you are certainly aware of this widespread phenomenon.

So, how much money do you need to be relieved of financial stress? There is a dollar amount and apparently, it’s $1.2 million.

This figure comes from a 2023 Empower “Financial Happiness” study conducted by The Harris Poll. Technically, the respondents were asked about financial happiness rather than stress, but the connections between money and stress, as well as the associations between emotional well-being and financial security, are well established, so we will go ahead and make the leap.

Problem-Solvin’ Moolah

The study revealed that 71% of respondents felt money would solve most of their problems. Before you start thinking this is a shallow revelation, understand that most respondents were referring to financial goals as simple as paying bills on time, getting out of debt, and owning a home.

Money is a stress reliever in that it offers a sense of control. Unexpected expenses are stressful enough when you can swing them, but a little extra cash flow can save a lot of headaches and sleepless nights. A blown-out tire on the highway sends anyone’s blood pressure skyrocketing, even when their bank account can manage the tow and replacement tire. But imagine if your Christmas plans got blown up with your blowout. So much for your Goodyear.

Grasping that sweet, sweet financial stress relief

There are two ways, seemingly at odds, to relieve financial stress: Have a financial plan, and – get this – spend money.

The former is intuitive and confirmed by the Empower study with 73% of respondents agreeing that “a solid financial plan would bring me happiness”.

The latter seems counterintuitive, but according to Hubble, spending money in moderation can have a stress-relieving effect. Making a desired purchase causes the brain to release dopamine, a chemical associated with reward and satisfaction, which can reduce stress. Additionally, spending money on something you want can establish a sense of control and provide a distraction from life’s stressors. Obviously, overspending generates stress, so there is a balance to strike.

I remember a time in my life particularly filled with work stress. When I felt the stress building up in me, I would go online and purchase high-end organic soaps. I’m not sure why. I rarely even used them and would often give them away as gifts. But the purchases would relax me. Weird, huh?

Where’d this $1.2M come from?

Why $1.2 million?

Clearly, lifestyle expectations are a factor in terms of how much is enough. A modest, minimalistic, childless existence in the Midwest requires considerably less dough for comfort than a socially thriving, multi-child lifestyle in a posh Manhattan flat. This fact was demonstrated in the viral article by Financial Samurai, “Scraping by on $500,000: Escaping the Rat Race.”

I would argue, however, that a high-salaried, high-expenses family that is “barely scraping by” still has the sense of stress-relieving control afforded by the option to downsize if needed – especially since they usually have the types of careers that garner an above-average salary wherever they go.

Conversely, a modestly paid technician may have spent years building up a comfortable, stress-reducing savings account that an economic downturn could wipe out in a matter of months.

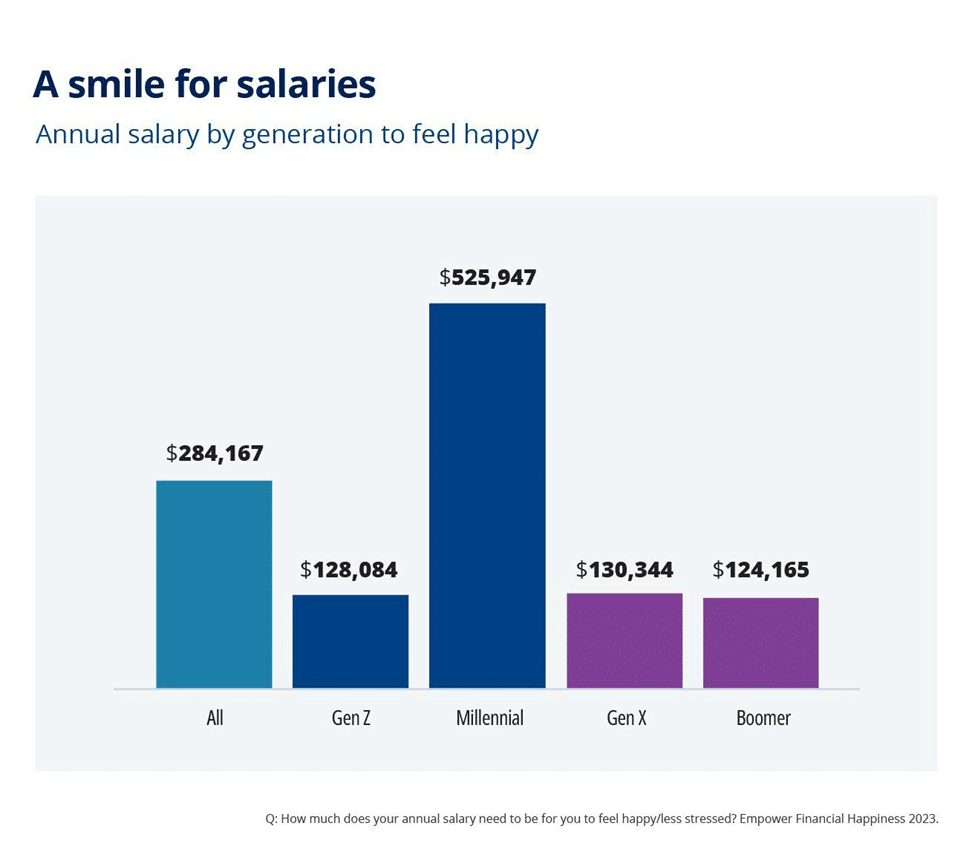

So, the $1.2 million figure is an average and it’s relative. But that is merely a net worth value. The average salary required for financial happiness according to the Empower study came out to $284,167 per year.

Let’s just take a quick moment to note that the median salary in the U.S. is a decidedly unhappy $58,000.

The annual “happy” salary is larger than most. But where this average sought-after salary really gets interesting is in the breakdown between generational cohorts. In fact, there are a handful of interesting generational differences that have come out of this study.

Generational must-haves

Remember when I said a couple of paragraphs ago that the average salary required for financial happiness is $284k? Well, that average is severely skewed by Millennials. Boomers, Gen X, and Gen Z all came in with similar smile-producing salaries of around $130k. But Millennials report needing an annual salary of $525,947 to be happy!

Why do they feel they need such a large salary? It could be because of the economic chaos they’ve seen as adults, from the 2008 economic crisis to the pandemic. But they also seem to view money differently than the other age groups. The study showed that Millennials are both most likely to say that money buys happiness and they are most likely to spend money for indulgences, like a $7 daily coffee.

It could be that Millennials are simply most likely to value the little pleasures and daily indulgences of life and they are correctly aware of how expensive those things can be. Don’t forget, this is the highfalutin generation that killed the paper napkin industry just to watch it die.

Gen Z is interesting in a different way. This group of twenty-somethings doesn’t need a ton of money to be happy. In fact, of all the generations they were the least likely to say money buys happiness. But they are all in on work/life balance and they expect to retire the youngest of any age group! As a Gen Xer who always thought I would have to work until I die and maybe a few years after that, I think this is so illuminating. Gen Z seems more interested in time than indulgences. Another reason I am so fascinated with this cohort.

Read more about what I think of Generation Z here.

Boomers, mostly retirees nowadays, said they were more concerned about taking care of themselves and spending their money than passing it on to future generations. They were also least likely to value work/life balance. I suggest perspectives from those who have left the workforce or soon will are bound to be different, particularly in these areas.

Responses from Generation X were not surprising. They were the most likely to be concerned about debt. When asked whether they were prepared to retire, more Gen X respondents said “no” than Millennials, despite Millennials having more time on the clock. Maybe we will end up being the oldest working generation after all. Oh, and the definition of financial happiness according to most Gen Xers? Retiring by a certain age. Good luck, Slackers! I mean that endearingly.